Most of the steps are similar to 11i version.

Before we proceed to core configuration let us understand the new feature and architecture

Ledger Architecture

Legal and Management hierarchy

Legal Entity: Now different accounting rules can be configured for legal entity – UK GAAP / US GAAP / France Stat. This is the basis for Ledger, which will then link to one or more operating units.

Legal Ledger: Accounting representation of Legal entity. This will be linked to one or more legal entities, which in turn may have single or multiple balancing segment values. Separate SLA can be configured for each ledger.

Management Ledger: Similar like legal ledger but not link to legal entity. Associate with one or more management segment values. This is mainly for management adjustment and reporting.

Ledger Sets: Logical grouping of legal ledgers and / or management ledgers. These ledgers can have different currency (!) but shares the same COA and calendar. It is possible to attach each ledger to different ledger sets.

Confusing!

Let us learn to create one simple ledger.

1. Chart Of Accounts (COA) - this is also known as accounting structure. Here we need to compile Accounting Key Flexfield. This should be defined and designed according to client's requirement. This plays a very vital role in entire application. Refer ‘COA Change’ article.

There is one more new Flexfield qualifier – Management segment.

To perform management reporting we need to assign management segment qualifier to any one of the segment in our COA. The management segment can be any segment except the balancing segment or natural account segment. This segment can be linked to anything example: LOB (line of business).

This is similar to 11i version

2. Currency - This must be enabled

This is similar to 11i version

3. Calendar - This should be defined and validated. Here is the place where we will decide whether client needs calendar or fiscal and number of non adjusting period required. Define the calendar type and link to calendar.

This is similar to 11i version

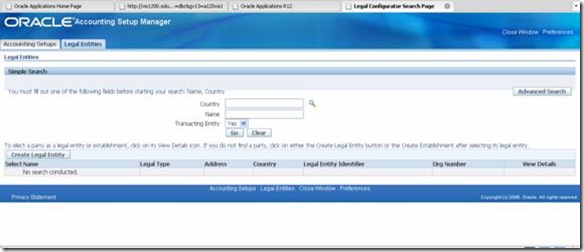

4. Define Legal entity – use legal entity configurator or GL accounting setup manager to configure legal entity.

Navigation

Click the button create legal entity

Define legal entity – this is just free page entry

5. Define ledger and group 3 C’s (COA, Currency and Calendar) – similar to 11i version where we group 3’c in SOB window.

Click create accounting setup

Group 3 C’s configured

Here we need to attach SLA (Subledger Accounting) Method – there are few seeded SLA, which can be used. Example – ‘Standard Accrual’. However we can customize or create our own SLA rules and attach here or later.

Click next and finish the configuration.

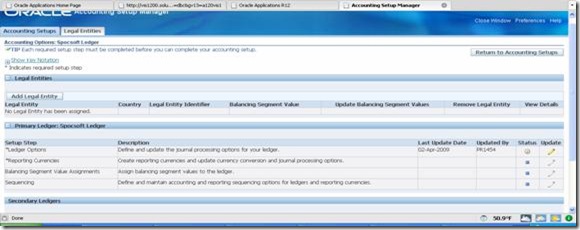

6. Attach Legal entity defined in step 4.

Click add legal entity button and attach

7. Define Accounting Options

Click the link of ledger options and complete the setup. Here we configure first open period, SLA method, retained earning account (similar to 11i version) etc

After completing the configuration status will be green as follows

Click the complete button after fully configured (for practice just complete only ledger options)

After completion we can’t change the legal entity attached, balancing segment values attached and reporting currencies linked to Ledger.

Ledger is similar to SOB in 11i version.

8. Attach Leger to your GL responsibility

9. Open and Close Period.

Open the first period.

Often we may have to decide whether we need single Ledger or Multiple Ledger during process mapping and solution designing. One important rule is to check whether client needs changing of 3 C’s, different period maintenance and SLA method.

10. Start using GL

No comments:

Post a Comment