Oracle Payroll provides data-driven approach that enables to define and manage diverse payroll requirements, which will reflect business payroll policies. Oracle Payroll easily recalculate individual payroll payments and for large employee database, the Oracle Payroll system allows for multiple groups of employees to be processed simultaneously thus reducing the processing time.

I have tried to cover how to configure Oracle Payroll as much as possible with screen shots. This will help to complete the entire configuration of Oracle Payroll.

Define consolidation before define payroll

Default BG will appear sooner we click ctl +f11. It is BG specific.

Payroll> Consolidation

Define Period type – Define the type with number per year. This is applicable across the BG.

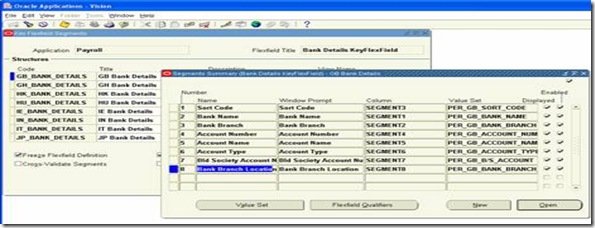

Define bank details KFF

In payment method window (Payroll > payment method in HR) we can see this KFF while entering values in bank details field

Define payment method – This is BG specific. It is a lookup code. Payroll> Payment methods.

Enter complete details in bank details KFF. If we don't enter, we may face reconciliation issues with CE

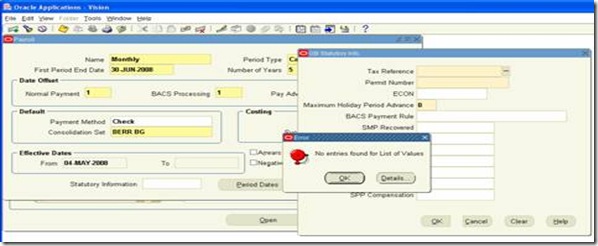

Define Payroll

Payroll > Description

We need to define statutory information before we define this setup otherwise we will get the following error

To avoid this error first define

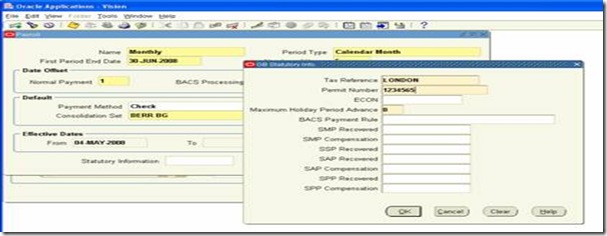

Fill up all the mandatory details

Now define the payroll – system will not through any error

This has to be defined per BG. Defined in other BG can’t be seen.

Select the period type defined in earlier step in period type field.

Define now statutory information

Define GL Flexfield MAP

To load legislation code use create_element_entry API.

Define Element Classification – Total compensation>basic>Classification.

We can enable the check box if it is payment otherwise like for just information we can enable the check box non payment.

For deduction like national insurance – NI – we can use credit as follows

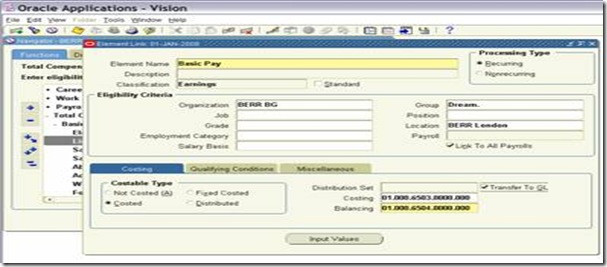

Define elements – Total Compensation>basic>element description (this is across the BG)

Click Input values button

Element Link

Total compensation > Basic > Link - here only we are giving actual link of element to organization / job / position / payroll / salary basis etc. Optionally we can give link to all payrolls. If we need to give this element link only to particularly payroll, we should not enable the check box link to all payrolls.

It should be costed so enable the radio box costed, enter the FF combinations for costing and balancing and enable the check box transfer to GL

Select the element created in the previous step from LOV

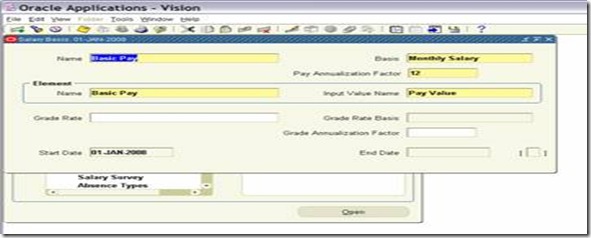

Salary basis

Use the Salary Basis window to define a salary basis for each salary element to be used for salary administration. This establishes the duration for which a salary is quoted, for example, hourly, monthly or annually.

Total compensation > basic > Salary basis

Create employee- enter and maintain employee

Mention address through address button at the header window.

Attach this employee in User window.

While creating employee records attach payroll to the employee.

We need to enter salary basis to avoid the following error

Attach the salary basis – this is important to define the salary rate for elements

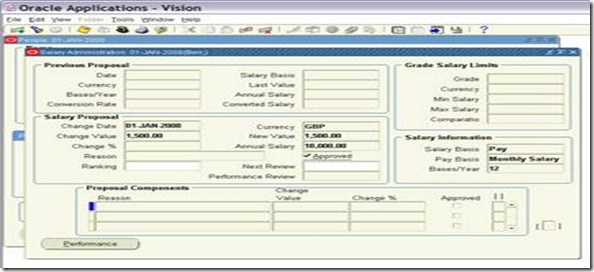

Enter now the salary for each element defined in salary basis > click salary button

Enter the element entries > click the entries button

Enter entry values > click the button enter values

Now run the quick pay > select quick pay TAB by clicking the others button

Input the values and click start run button

After it has completed click the button view results and click SOE (statement of earning) report

We can make external payment by clicking the external payment button and enter the check number

View payroll results

View > payroll process results

Click process information

2 comments:

Hi,

Thanks for the information you have provided and is very useful.

However, I am not able to see the screenshots clearly.

Hi,

i hope you are doing grate..

Please share documents to me it is very useful

Mail:gorantlasrao44@gmail.com

Thanks & Regards

Srinivas.G

Post a Comment