We need to account the money that is paid back (refund) to customer in apps. In 11i we are forced to create customer as a supplier, pass credit memo, prepare invoice manually in AP and issue payment in AP. There is a new functionality to pay back money to customer in R12.

Example for Refund: Amount paid back because of an over collection or the return of goods sold called refund. or The reimbursement of the purchase price of a good or service, for reasons such as defective goods or dissatisfaction with the service provided to customer.

How to make manual refund to customer?

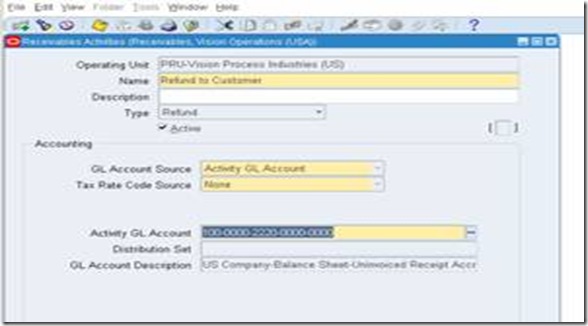

Create Refund activity

Query your Receipt and Customer

Refund the money to customer, which was parked in unapplied account

Apply to refund activity. If applied against the transaction, unapply first and apply against refund activity.

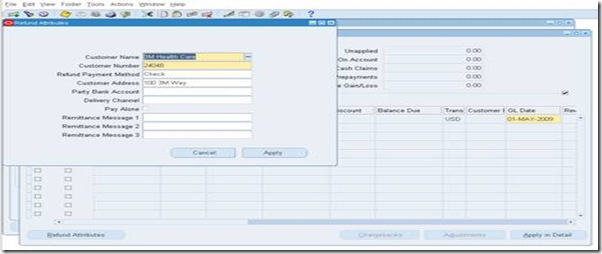

Click refund attributes and provide the details

Save the record

Sooner we save the record successfully we can see Refund Status button

Click refund status. Refund status is not applicable for credit card refund.

We can see the AP invoice created by the system automatically for the trading partner.

Create receipt accounting in Receivables.

View Journal Entry

Debit – Cash

Credit – Payables Clearing (Reader can use any clearing account to set off against payables debit)

Go to Payables > System has created payable invoice in AP automatically for Trading Partner

Approve the invoice

Create invoice accounting in Oracle Payables.

View journal entry

Debit – Payables clearing (What has been credited in AR)

Credit – Liability

Make payment

Create Payment Accounting

View Accounting

Net Entry

Receivables

Debit Cash – 1110

Credit Payables Clearing – 2220

Payables

Invoice

Debit Payables Clearing – 2220

Credit Liability – 2210

Payment

Debit Liability – 2210

Credit Cash – 1110

Net Effect will be zero at GL level.

15 comments:

Your blog keeps getting better and better! Your older articles are not as good as newer ones you have a lot more creativity and originality now keep it up!

Amiable brief and this enter helped me alot in my college assignement. Thanks you on your information.

Hi Raghu

Thanks for ur postings.Its really help to us.

I am facing one problem.

We integrated APPS with 3rd party billing system.Here we created invoice with 1000$ and created receipt 1000$ and applied also.Now we got credit memo with -500$ and created same in AR using auto invoice.

My problem is creating receipt.We got receipt with -500$ for credit memo, but system cant accept receipt with -ve amount.I got error while creating receipt with -ve amount using AR_RECEIPT_API_PUB.create_and_apply API.

Error message :You cannot enter a negative receipt amount for cash receipts

Please help me as I don't have that much functional knowledge.

Hi Narayan,

We cant create negative receipt and your error is correct as per the system.

Always AR will work with positive amount for receipt and refund as AP always work with negative amount for refund.

Solution - Raise positive transaction,adjust the credit memo and make refund. This is exactly like how we can collect refund from supplier in payables. This is more of apps solution.

Or Adjust the credit memo against the future transaction - this is more of practical project solution.

Thanks,

Raghu

Hi Raghu,

Can we do like this?.

Create a Debit Memo on AR and match the existing Credit Memo with this Debit Memo. Customer balance is now zero. The accounting for the Debit Memo should be:

DR Receivables

CR Clearing Account

Pay the customer by creating a Misc Receipt. The accounting for the Mis Receipt should be:

DR Clearing Account

CR Cash

Thanks

Hi All,

You can create receipt in negative, but not a 'standard' receipt but 'Miscellaneous' receipt.

Ragu,

Your articles are so good. It's really shows how strong you are you in Oracle EBS. Excelente.

I saw that "Net Effect will be zero at GL level"- that no meaning. But actually we need finally account like that ( after net off clearing acc)

Db: On-acc

Cr: Cash

Or

Db: Unapply acc

Cr: Cash

Seem new feature so bad

Excellent document for the learners.

Awesome blog, keep up good work

Good presentation, very helpfull.

One question, how is the refund done for credit card?

Thank you,

Edgar_villagran @ hotmail.com

Hi Raghu,

Thank you very much for such a detailed explantaion.

I've one question: Is there any way we can stop the process by creating the Refund activity in AR? We don't have connection between AP and AR. User wants to create the Refund activity in AR and leave it there (it will be a credit to a suspense acct) and take care of the payment outside of the system.

I'm not able to give you the entire scenario but my only question is whether we will be able to stop the Refund going back to AP or not.

Help is much appreciated!

Hi

What will be impact of refunds made to customer for PA invocies? I mean wil that information flow to Projects module.

reagrds

roli

Hi,

Could you please tell us if we can refund more amount to customer than the receipt amount.

Thanks

OK, I followed all your steps, but the Create Accounting process in AP does not generate the accounting entries: as my AP Liability is a control account, the system looks for required info that does not exist because the third party is not a supplier, it's a client: "- The account combination XXX for line 2 is a control account. Please provide a third party name and third party site for each subledger journal entry line that uses a control account."

How can we manage that?

Thanks raghu it was very helpful .......

Post a Comment